Imagine an economy which has experienced 2.8% real growth annually on average since 2009, with inflation only starting to creep higher this year to 1.7% in May, close to the central bank’s 2% target. The unemployment rate has fallen from a peak of 9.3% at the beginning of 2010 to 6.7% in May. It is expected to have a balanced budget and a current account surplus in excess of 4% this year. With that in mind, what would be your best guess about its central bank’s recent monetary policy decision? Some form of tightening or a hawkish stance? Dead wrong! It decided not only to maintain its target rate at -0.5%, but to expand quantitative easing (QE). This anecdotal example from Sweden says a lot about the current degree of accommodation provided by the major central banks, in a context that has improved markedly since the financial crisis. In other words, the majority of central banks input is far too large today.

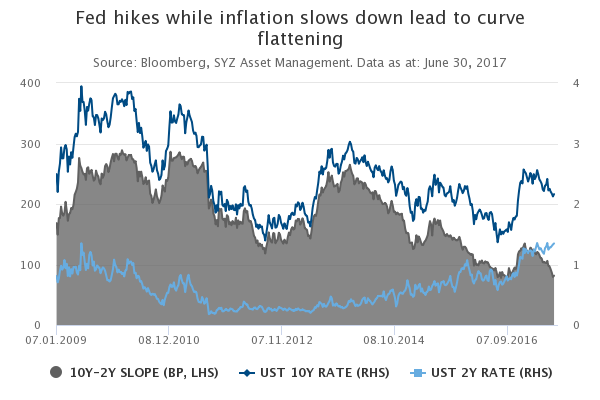

The risks are either that economic and inflation expectations dive suddenly or central banks start realising that the side-effects of their ultra-loose policy are getting larger than the expected benefits. We strongly believe the likelihood of a recession should remain low in the foreseeable future, especially as monetary policies remain unchanged. However, our main concern is an unordered re-pricing of some yield curves, especially in Germany or the US, on the back of a tentative normalisation from the ECB, a rate hike from the Fed in September or, to a lesser extent, some fiscal measures from Trump.

In this environment, the duration and risk stances in our multi-asset portfolios were kept respectively to a disinclination (--) and mild preference (+). The equity allocation preferences have been tilted toward some geographical areas such as Europe (++) and Japan (from – to +). Note that financial and industrial sectors, value style and small-caps should also perform well in this more challenging context for fixed income. In this area, US nominal bonds, which were our "least bad" choice for duration so far this year, were downgraded to mild disinclination (-) because we expect positive surprise as the consensus has probably become too pessimistic on the US economic outlook. In the currency space, while the euro (+) should continue to appreciate against the USD, we cannot exclude a short-lived and contained rebound of the dollar, consistent with our cautiously optimistic outlook for the US.

_Fabrizio Quirighetti